CORRESP: Correspondence

Published on January 3, 2025

|

John-Paul Motley +1 213 561 3204 jpmotley@cooley.com

|

|

January 3, 2025

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Technology

100 F Street, N.E.

Washington, D.C. 20549

Attention: Becky Chow and Stephen Krikorian

Re: Veritone, Inc.

Form 10-K filed on April 1, 2024

Comment Letter dated December 6, 2024

File No. 001-38093

Ladies and Gentlemen:

On behalf of Veritone, Inc. (the “Company”), this letter sets forth the Company’s responses to the comments provided by the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) in a letter dated December 6, 2024 (the “Comment Letter”) relating to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”) filed with the Commission on April 1, 2024.

For your convenience, each comment of the Staff from the Comment Letter has been set forth in italics below and each of the Company’s responses have been provided immediately thereafter. Please note that the headings and numbering set forth below correspond to the headings and numbering reflected in the Comment Letter.

Form 10-K for the year ended December 31, 2023

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Opportunities, Challenges and Risks, page 39

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 2 |

|

Response:

The Company respectfully advises the Staff that, in future filings, the Company will include a discussion of the change in GAAP gross profit and GAAP gross margin, the most directly comparable GAAP numbers to non-GAAP gross profit and non-GAAP gross margin, in substantially the format shown below (indicative for the Company’s Annual Report on Form 10-K for the year ending December 31, 2024):

For the year ended December 31, 2024, our total revenues were $[__] million as compared to $127.6 million for the year ended December 31, 2023, a[n] [increase/decrease] of [__]%, driven by [_____].Our gross profit for the year ended December 31, 2024 was $[__] million as compared to $[__] million for the year ended December 31, 2023, a[n] [increase/decrease] of [__]%, driven by [_____]. Our gross margin for the year ended December 31, 2024 was a negative [ ]%, a change of [ ]%, compared to our gross margin of [__]% for the year ended December 31, 2023, primarily due to [_______]. For the year ended December 31, 2024, our non-GAAP gross margin (calculated as described in “Non-GAAP Financial Measures” below) [increased/decreased] to approximately [__]% as compared to [__]% for the year ended December 31, 2023, driven by [_______]. Historically, our gross margin and non-GAAP gross margin have been impacted significantly by the mix of our Software Products & Services revenue and our Managed Services revenue in any given period because our Managed Services revenue typically has a lower overall non-GAAP gross margin than our Software Products & Services revenue. We expect our revenue mix to have less of an impact in future periods because our Managed Services revenue will meaningfully decrease as a result of our sale of our wholly owned subsidiary, Veritone One LLC in October 2024. Gross profit and non-GAAP gross profit (calculated as described in “Non-GAAP Financial Measures” below) are also dependent upon our ability to grow our revenue by expanding our customer base and increasing business with existing customers, and to manage our costs by negotiating favorable economic terms with cloud computing providers such as AWS and Microsoft Azure. While we are focused on continuing to improve our gross profit and non-GAAP gross profit, our ability to attract and retain customers to grow our revenue will be highly dependent on our ability to implement and continually improve upon our technology and services and improve our technology infrastructure and operations as we experience increased network capacity constraints due to our growth.

Non-GAAP Financial Measures and Key Performance Indicators, page 41

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 3 |

|

Response:

The Company respectfully advises the Staff that it intends to provide the following non-GAAP financial measures in future filings: non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income (loss), and non-GAAP net income (loss) per share. In future filings that include these non-GAAP measures, the Company also intends to provide the explanation below for why the Company believes that such non-GAAP measures are useful to investors in evaluating the Company’s financial condition and results from operations. As noted in the response to comment 5 below, the Company will no longer provide the following non-GAAP financial measures in its future filings: pro-forma software revenue, non-GAAP cost of revenue, non-GAAP sales and marketing expenses, non-GAAP research and development expenses, non-GAAP general and administrative expenses, non-GAAP loss from operations, non-GAAP other expense, net, and non-GAAP loss before income taxes.

Non-GAAP gross profit is calculated as gross profit with adjustments to add back depreciation and amortization and stock-based compensation expense. Non-GAAP gross margin is defined as Non-GAAP gross profit divided by revenue. Non-GAAP net income (loss) and non-GAAP net income (loss) per share is calculated as the Company’s net income (loss) and net income (loss) per share, adjusted to exclude loss (income) from discounted operations, net of income tax, (benefit) provision for income taxes, depreciation expense, amortization expense, stock-based compensation expense, changes in fair value of contingent consideration, interest expense, net, foreign currency gains and losses, gain on debt extinguishment, acquisition and due diligence costs, gain or loss on sale of investment assets, loss from business held for sale, variable consultant performance bonus expense, and severance and executive transition costs.

We present non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income (loss), and non-GAAP net income (loss) per share because management believes such information to be important supplemental measures of performance that are commonly used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Management also uses this information internally for forecasting, budgeting and measuring annual bonus compensation targets for its executive personnel, including its named executive officers. Our non-GAAP gross profit and non-GAAP gross margin allow investors and our management team to analyze our operating performance by excluding expenses that are not directly related to the cost of providing goods and services. Our non-GAAP net income (loss) provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as it eliminates the effect of items that are often unrelated to overall operating performance.

These non-GAAP financial measures are not calculated and presented in accordance with GAAP and should not be considered as an alternative to net income (loss), operating income (loss) or any other financial measures so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. Other companies (including our competitors) may define these non-GAAP financial measures differently. These non-GAAP measures may not be indicative of our historical operating results or predictive of potential future results. Investors should not consider this supplemental non-GAAP financial information in isolation or as a substitute for analysis of our results as reported in accordance with GAAP.

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 4 |

|

Response:

In response to the Staff’s comment, in future filings, the Company will present GAAP measures of gross profit and gross margin with equal or greater prominence than non-GAAP gross profit and non-GAAP gross margin, and will include the necessary reconciliations of non-GAAP gross profit and non-GAAP gross margin to the GAAP measures of gross profit and gross margin, respectively.

Response:

The Company respectfully advises the Staff that it believes the add-backs for variable consultant performance bonus expense and severance and executive transition costs are consistent with, and permissible under, the guidance in Question 100.01 in the Compliance and Disclosure Interpretations on Non-GAAP Financial Measures.

The add-back for variable consultant performance bonus expense related solely to payments made under a consulting agreement with Chad Steelberg to ensure a smooth transition after his resignation as Chief Executive Officer. Chad Steelberg had been the Company’s Chief Executive Officer since its inception in June 2014 until his resignation on December 31, 2022. Under the consulting agreement, the Company paid to Chad Steelberg a fixed monthly fee and potential performance bonus payments based on the achievement of certain technological milestones that Chad Steelberg contributed to. The Company did not adjust for the fixed monthly cost of the consulting agreement with Chad Steelberg, because it viewed such monthly fee as an ordinary course expense. The Company did, however, add back the variable performance bonus expense because the Company viewed the performance bonus as unique to technological milestones that Chad Steelberg was being requested to focus on during his transition and not a normal, recurring operating expense. Further, the Company and Chad Steelberg amended in the consulting agreement in January 2024 to remove the performance bonus payments. Therefore, Chad Steelberg was paid a bonus only for his services during 2023 and the add-back will not appear in 2024 or future periods.

The add-back for severance and executive transition costs included severance expenses related to the departure of Chad Steelberg as Chief Executive Officer and expenses related to cost reduction measures implemented by the new Chief Executive Officer to reflect a restructuring of the organization and the implementation of a new strategic plan to return the Company to its core business. The Company

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 5 |

|

viewed these expenses as incident only to the transition in Chief Executive Officer, both to assist in a smooth transition in leadership and to implement the strategic plan to return the Company to its core business and optimize the Company’ s operational performance. These costs were made up principally of severance and transition costs that were non-recurring in nature and implemented in a discrete period of less than 18 months.

For these reasons, the Company does not view add-backs for variable consultant performance bonus and severance and executive transition costs as normal, recurring operating expenses and the Company believes the adjustments are consistent with, and permissible under, the guidance in Question 100.01.

Response:

The Company respectfully advises the Staff that, in response to this comment and comment 3 above, the Company will no longer provide the following non-GAAP financial measures in its future filings: pro-forma software revenue, non-GAAP cost of revenue, non-GAAP sales and marketing expenses, non-GAAP research and development expenses, non-GAAP general and administrative expenses, non-GAAP loss from operations, non-GAAP other expense, net, and non-GAAP loss before income taxes. The Company expects to continue providing the following non-GAAP financial measures in its future filings: non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income (loss), and non-GAAP net income (loss) per share.

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 6 |

|

Response:

The Company respectfully advises the Staff that, in future filings, it will not provide the table that shows the reconciliation of non-GAAP net loss among Core Operations, Corporate and Total. While the table will no longer be provided, the Company will continue to show consolidated non-GAAP net loss as reflected elsewhere in its filings and include the corresponding reconciliation table to consolidated GAAP net loss.

Software Products & Services Supplemental Financial Information, page 44

Response:

The Company respectfully advises the Staff that it does not intend to continue to disclose “Pro Forma Software Revenue” in its future filings.

Managed Services Supplemental Financial Information, page 45

Response:

The Company respectfully advises the Staff that it discontinued providing the supplemental financial information for Managed Services referenced in the Staff’s comment beginning with its Quarterly Report for the quarter ended September 30, 2024, including “Revenue during the quarter” for Managed Services. The Company stopped providing this supplemental information because it sold all of the issued and outstanding equity of its wholly owned subsidiary, Veritone One, LLC, on October 17, 2024. Veritone One was a full-service advertising agency that provided Managed Services to its customers and represented approximately 43% of the Company’s total Managed Services revenue. As a result, Managed Services will be a less meaningful percentage of total revenue mix in the future. Accordingly, the Company determined that it will no longer present supplemental financial information for its Managed Services business. The Company provided this explanation in its Quarterly Report for the quarter ended September 30, 2024 on page 41 under “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Supplemental Financial Information.”

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 7 |

|

Note 3. Business Combinations and Divestiture, page 77

Response:

The Company respectfully advises the Staff that the pro forma financial information reflecting the Company’s acquisition of Broadbean (as defined in the Company’s financial statements included in the 2023 Form 10-K) was inadvertently presented for the acquired entity only and should have been for the combined entity as if Broadbean had been acquired on January 1, 2022. Management does not believe this inadvertent error was misleading to investors because the Company had previously provided Article 11 compliant pro forma financial statements in its Current Report on Form 8-K, filed on August 28, 2023, and it also included pro forma revenue information for the Broadbean acquisition in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Supplemental Information” on page 45 of the 2023 Form 10-K. In addition, the Company included the correct pro forma financial information for the Broadbean acquisition on page 11 of its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed on November 14, 2023. The Company advises the Staff that it will ensure the correct pro forma financial information for the Broadbean acquisition for the year ended December 31, 2023 is included in the Company’s upcoming Annual Report on Form 10-K for the year ended December 31, 2024.

The Company also advises the Staff that its acquisitions completed during 2022 were not material to the financial statements individually or in the aggregate. The incremental revenue and net income from acquisitions completed in 2022 that would have been included in pro forma revenue and pro forma net income for 2022 represented approximately 0.4% of the Company’s GAAP revenue and 0.2% of the Company’s net income for 2022. Accordingly, the Company did not include pro forma financial information for any of its acquisitions completed during 2022.

Notes to consolidated financial statements

Note 4 - Debt

Senior Secured Term Loan, page 83

Response:

In response to the Staff’s comment, the Company respectfully advises the Staff with respect to each of the topics raised as follows:

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 8 |

|

Gain on debt extinguishment

In December 2023, through separate and privately negotiated transactions with certain holders of the Company’s 1.75% convertible senior notes due 2026 (the “Convertible Senior Notes”), the Company repurchased $50 million aggregate principal amount of the Convertible Notes for an aggregate cash repurchase price of $37.6 million (which included the payment for the accrued and unpaid interest of $68,056). Concurrent with the repurchase, the Company issued $77.5 million aggregate principal amount of senior secured term loans (the “Term Loans”) and warrants to lenders who were also holders of the Convertible Notes that participated in the repurchase of the Convertible Notes. Each lender’s participation in the new Term Loans and warrants was pro-rata based on the lender’s repurchased principal amount of Convertible Notes. In the repurchase agreements, the holders of the Convertible Notes (who were also the lenders under the Term Loans) and the Company agreed that the closing of the repurchase of the Convertible Notes would take place concurrently with the funding of the Term Loans. The Company determined that the aggregate fair value of the Term Loan and the warrants was $53.7 million and $4.8 million, respectively, through assistance by a third-party valuation expert. The fair value of the warrants was determined using a Black-Scholes option pricing model which factored in the exercise price, term of the warrants, risk free rate, volatility, and other inputs.

The Company concluded that the repurchase of the old debt (the Convertible Notes) and issuance of the new debt (the Term Loans) and warrants from the same lenders was a debt restructuring for each participating lender. No lender held any other debt of the Company prior to the repurchase of the Convertible Notes. Thus, for each lender who participated in the transaction, the Company assessed the debt restructuring (i) to first determine whether the restructuring should be accounted for as a troubled debt restructuring (“TDR”) under ASC 470-60 and (ii) if it is not subject to accounting under TDR, then to determine whether it is subject to a debt modification or extinguishment accounting under ASC 470-50.

For the lender concession test under the TDR evaluation in accordance with ASC 470-60-55-10 through ASC 470-60-55-14, we included the warrants in the day one cash outflows as new sweeteners to the debt restructuring in accordance with ASC 470-60-55-12. We further considered the cash amount received from the new debt issuance as the day one cash inflows and all potential payments (cash outflows) under the Term Loans including the periodic principal and the coupon interest payments. We then calculated for the discount rate that equated to the present value of the cash flows under the new terms to the carrying value of the repurchased Convertible Notes. As the effective borrowing rate on the restructured debt (the Term Loan) is higher than the effective borrowing rate on the old debt (the Convertible Notes) immediately before the restructuring, we determined that each of the participating lenders did not grant a concession. Given TDR accounting requires both the Company to be experiencing financial difficulty and the lenders to have granted a concession, the TDR accounting does not apply to the debt restructuring.

For the debt modification assessment under ASC 470-50, we determined that the elimination of the conversion feature in the Term Loan compared with the Convertible Notes may be viewed as a debt extinguishment pursuant to ASC 470-50-40-10 (b) as the conversion feature of the Convertible Notes may be viewed as substantive at the debt restructuring date. However, in accordance with ASC 470-50-40-10 and ASC 470-50-40-12, we further evaluated whether the instruments (the Term Loan and the Convertible Notes) are considered “substantially different” (i.e., when the present value of the cash flows under the terms of the new debt instrument is at least 10% different from the present value of the remaining cash flows under the terms of the original instrument (which is generally referred to as the “10% Test”). We performed the 10% Test under scenarios including immediate prepayment and payment at maturity. As the cash flow assumption that generates the smaller change is still greater than 10%, we concluded that the debt restructuring should be accounted for as a debt extinguishment.

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 9 |

|

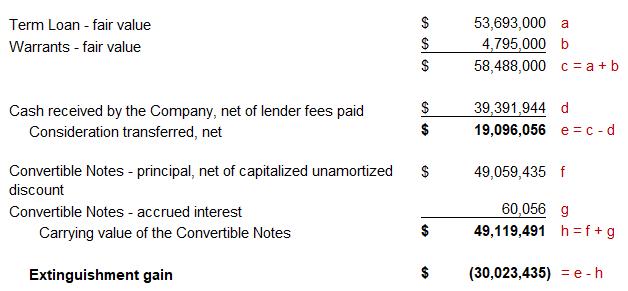

Per ASC 470-50-40-13 and ASC 470-50-40-2, we calculated the difference between the reacquisition price and the net carrying amount of the extinguished Convertible Notes as the gain on the debt extinguishment (i.e., $30.0 million). The reacquisition price is computed as the aggregate fair values of the Term Loan and the warrants issued, reduced by the net cash amount received by the Company from the lenders; and the net carrying value of the extinguished Convertible Notes is the sum of the repurchased principal, net of the corresponding portion of the unamortized capitalized issuance costs, plus the accrued but unpaid interest on the repurchased debt, as presented below:

We further considered whether the extinguishment gain should be recognized as an equity transaction. As there are significant debt holders that do not own equity in the Company immediately prior to the debt restructuring and they are not related parties, we concluded that the gain should not be recorded in equity.

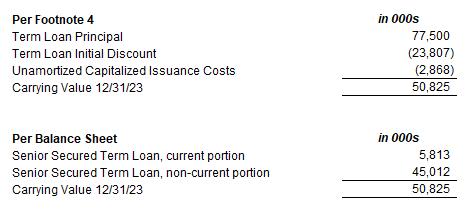

Basis for determining the initial discount and the value of the warrants

As mentioned above, we recorded the Term Loan at fair value to comply with the requirement under ASC 470-50-40-13. We recognized $23.8 million, the excess of (i) the par value of the Term Loan of $77.5 million over (ii) the fair value of $53.7 million, as a debt discount. In addition, we incurred $3.1 million to third parties working directly on the debt restructuring which was capitalized and accounted for as an incremental debt discount. Thus, according to ASC 835-30-45, we recorded the $26.9 million debt discount (the sum of $23.8 million and $3.1 million) as an adjustment to the carrying value of the Term Loan which is amortized over time to interest expenses based on the effective interest method.

As noted above, the fair value of the warrants was determined using a Black-Scholes option pricing model which factored in the exercise price, term of the warrants, risk free rate, volatility, and other inputs. The fair value of the warrants was not capitalized as a debt discount as the warrants were consideration transferred to the lenders in connection with the debt restructuring and accounted for part of the debt extinguishment gain (i.e., the initial fair value of the warrants was expensed). We further note that guidance under ASC 470-20-25-2 may not be applicable in our transaction as our sale of debt instrument with the warrants were completed in connection with the repurchase of our existing debt. As mentioned above, we

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 10 |

|

treated the transaction as a debt restructuring, not a standalone new debt and warrant issuance. In addition, if we analogize ASC 470-20-25-2 to allocate issuance costs incurred by us to the warrants, the amount allocated to the warrants would be immaterial, and thus, we waived such allocation.

Reconciliation table for carrying value of Term Loans

As of December 31, 2023

As of December 31, 2022

The Term Loan was issued in December 2023 and there was no carrying value associated with this instrument as of December 31, 2022.

* * *

|

|

|

|

|

U.S. Securities and Exchange Commission January 3, 2025 Page 11 |

|

Please contact me at (213) 561-3204 with any questions or further comments regarding our responses to the Staff’s comments.

Sincerely,

/s/ John-Paul Motley____

John-Paul Motley

Cooley LLP

cc: Michael L. Zemetra, Veritone, Inc., Chief Financial Officer

Craig Gatarz, Veritone, Inc., Chief Legal Officer and Secretary

Logan Tiari, Cooley LLP, Partner