DEF 14A: Definitive proxy statements

Published on June 25, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

|

|

☐ |

|

Soliciting Material Under §240.14a-12 |

VERITONE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|||

|

☒ |

|

No fee required |

||

|

|

|

|||

|

☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

|

|

||

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5) |

|

Total fee paid:

|

|

|

|

|||

|

☐ |

|

Fee paid previously with preliminary materials. |

||

|

|

|

|||

|

☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing fee for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

|

|

||

|

|

|

(1) |

|

Amount previously paid:

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3) |

|

Filing party:

|

|

|

|

(4) |

|

Date Filed:

|

VERITONE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

July 24, 2020

To the Stockholders of Veritone, Inc.:

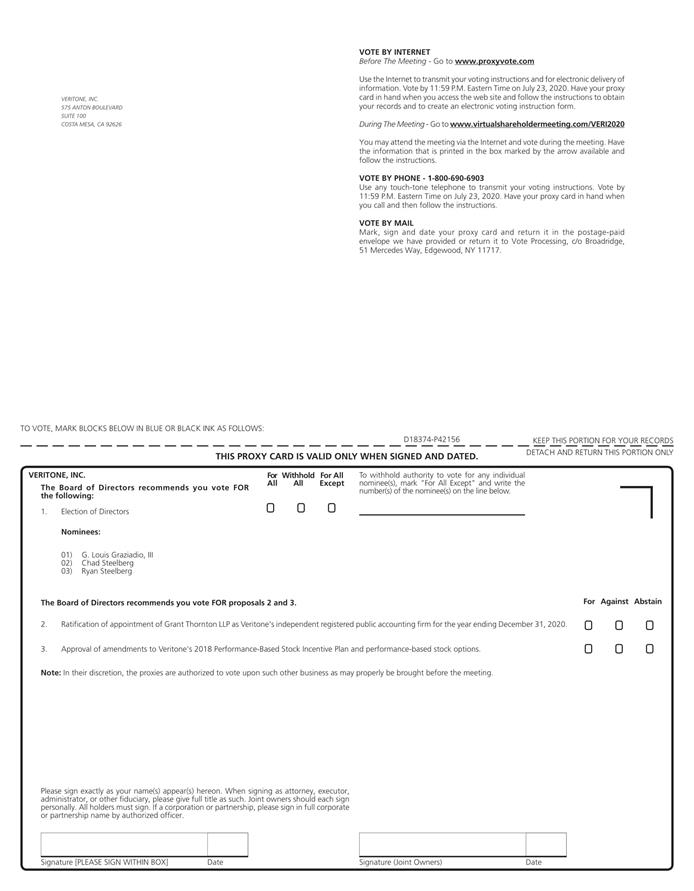

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Veritone, Inc. will be held on Friday, July 24, 2020, at 9:30 a.m., Pacific Time. The annual meeting will be a virtual meeting via live webcast on the Internet. Stockholders may attend the annual meeting online by visiting www.virtualshareholdermeeting.com/VERI2020. The annual meeting is being held for the purpose of considering and acting upon the following:

|

|

1. |

To elect three directors named in the proxy statement as Class III directors to serve for a term of three years; |

|

|

2. |

To ratify the appointment of Grant Thornton LLP as Veritone’s independent registered public accounting firm for the fiscal year ending December 31, 2020; |

|

|

3. |

To approve amendments to Veritone’s 2018 Performance-Based Stock Incentive Plan and performance-based stock options; and |

|

|

4. |

To transact such other business as may properly be brought before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on June 2, 2020 are entitled to notice of and to vote at the meeting. All such stockholders are cordially invited to attend the meeting. However, to ensure your representation at the meeting, you are urged to vote by proxy prior to the meeting. If you attend the meeting, you may vote during the meeting even if you have voted by proxy.

We encourage you to access the virtual annual meeting before the start time of 9:30 a.m., Pacific Time, on July 24, 2020, to allow ample time for online check-in, which will begin at 9:15 a.m. To attend the meeting, you will need the 16-digit control number provided on your proxy card or voting instruction form.

By order of the Board of Directors

/s/ Jeffrey B. Coyne

Jeffrey B. Coyne

Executive Vice President, General Counsel

and Secretary

June 25, 2020

Costa Mesa, California

|

YOUR VOTE IS IMPORTANT. EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE BY PROXY PRIOR TO THE MEETING. IF YOU CHOOSE TO VOTE BY MAIL, PLEASE DO SO PROMPTLY TO ENSURE YOUR PROXY ARRIVES IN SUFFICIENT TIME. |

PROXY STATEMENT

General Information

Proxy Statement and Solicitation of Proxies

Solicitation by Board

This proxy statement is being furnished in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at our Annual Meeting of Stockholders to be held on Friday, July 24, 2020 at 9:30 a.m., Pacific Time via live webcast on the Internet.

Solicitation of Proxies and Related Expenses

We will bear all expenses incurred in connection with this solicitation. We anticipate that this solicitation of proxies will be made primarily by mail; however, in order to ensure adequate representation at the annual meeting, our directors, officers and other employees may communicate with stockholders, brokerage houses and others by telephone, facsimile or electronic transmission, or in person, to request that proxies be furnished. We may reimburse banks, brokerage houses, custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy materials to the beneficial owners of the shares held by them. No additional compensation will be paid to our directors, officers or other employees for solicitation of proxies by such individuals.

Record Date and Voting Securities

Our Board has fixed the close of business on June 2, 2020 as the record date for the determination of stockholders entitled to receive notice of and to vote at the annual meeting. As of the record date, there were 27,098,995 shares of our common stock outstanding and entitled to vote. Each stockholder is entitled to one vote for each share of common stock held as of the record date.

Availability of Materials

On or about June 25, 2020, we are mailing this proxy statement and our Annual Report on Form 10-K and Amendment No. 1 to our Annual Report on Form 10-K/A for our fiscal year ended December 31, 2019, to all stockholders of record on the record date for the annual meeting. Except as may be required by Securities and Exchange Commission (“SEC”) rules and regulations, our Annual Report on Form 10-K, as amended, is not to be regarded as proxy soliciting material or as communications by means of which any solicitation is to be made.

We will provide without charge to each stockholder solicited by these proxy solicitation materials a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as amended, without exhibits upon request of such stockholder made in writing to Veritone, Inc., 575 Anton Boulevard, Suite 100, Costa Mesa, California 92626, Attention: Chief Financial Officer. We will also furnish any exhibit to such Annual Report on Form 10-K, as amended, if specifically requested in writing.

Stockholders Sharing the Same Address

SEC rules permit us to deliver one copy of our proxy statement and Annual Report on Form 10-K, as amended, to two or more stockholders who share an address, unless we have received contrary instructions from one or more of the stockholders. This delivery method, which is known as “householding,” reduces our printing costs, mailing costs and fees. Upon request, we will promptly deliver a separate copy of either document to you if you write us at our corporate offices at Veritone, Inc., 575 Anton Boulevard, Suite 100, Costa Mesa, California 92626, Attn: Chief Financial Officer or call us at (888) 507-1737. If you are a stockholder and share an address and last name with one or more other stockholders and would like to revoke your householding consent, or you are a stockholder eligible for householding and would like to participate in householding, please notify your broker, bank or other nominee (each, a “Nominee”) if your shares are held in “street name” or contact us at the above address or telephone number.

1

We have decided to hold our annual meeting as a virtual meeting this year to allow for greater participation by our stockholders while helping protect the health and safety of our stockholders, directors and employees due to public health concerns related to the COVID-19 pandemic. The virtual meeting has been designed to provide stockholders with the same rights to participate as they would have at an in-person meeting. All stockholders of record on the record date will be able to attend the meeting online, submit questions and vote shares electronically during the meeting. We intend to answer questions submitted by stockholders that are pertinent to the business of the annual meeting, as time permits.

The virtual annual meeting will begin at 9:30 a.m., Pacific Time, on July 24, 2020. You may attend the meeting by visiting www.virtualshareholdermeeting.com/VERI2020. We encourage you to access the virtual meeting before the start time to allow ample time for online check-in, which will begin at 9:15 a.m, to test Internet connectivity and to submit questions before the start of the annual meeting. To attend the virtual meeting, you will need the 16-digit control number provided on your proxy card or voting instruction form. All proxyholders and all stockholders of record on the record date who attend the virtual meeting will be deemed to be present in person at the annual meeting.

Even if you plan to attend the virtual annual meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the meeting.

Quorum

A quorum is the number of shares of capital stock of a corporation that must be present in person or represented by proxy in order to transact business. A majority of our shares of common stock entitled to vote, present in person or represented by proxy, will constitute a quorum at the annual meeting. Both abstentions and broker non-votes, each described below, are counted for the purpose of determining the presence of a quorum.

Abstentions

When an eligible voter attends the annual meeting, in person or by proxy, but decides not to vote on a proposal, the voter’s decision not to vote is called an “abstention.” Properly executed proxy cards that are marked “abstain” on any proposal will be treated as abstentions for that proposal. We will treat abstentions as follows:

|

|

• |

abstention shares will be treated as not voting for purposes of determining the outcome on any proposal for which the minimum affirmative vote required for approval of the proposal is a plurality or a majority (or some other percentage) of the votes actually cast, and thus will have no effect on the outcome; and |

|

|

• |

abstention shares will have the same effect as votes against a proposal if the minimum affirmative vote required for approval of the proposal is a majority (or some other percentage) of (i) the shares present and entitled to vote or (ii) all shares outstanding and entitled to vote. |

Broker Non-Votes

Broker non-votes occur when shares held in “street name” by a Nominee for a beneficial owner are not voted with respect to a particular proposal because (i) the Nominee does not receive voting instructions from the beneficial owner, and (ii) the Nominee lacks discretionary authority to vote the shares. We will treat broker non-votes as follows:

|

|

• |

broker non-votes will not be treated as shares present and entitled to vote for purposes of any matter requiring the affirmative vote of a majority or other proportion of the shares present and entitled to vote (even though the same shares are considered present for quorum purposes and may be entitled to vote on other matters). Thus, a broker non-vote will not affect the outcome of the voting on a proposal for which the minimum affirmative vote required for approval of the proposal is a plurality or a majority (or some other percentage) of (i) the votes actually cast, or (ii) the shares present and entitled to vote; and |

|

|

• |

broker non-votes will have the same effect as votes against a proposal for which the minimum affirmative vote required for approval of the proposal is a majority (or some other percentage) of all shares outstanding and entitled to vote. |

2

A Nominee only has discretionary authority to vote shares on a proposal that is considered a “routine” matter under applicable rules and related guidance. The proposal for the ratification of the appointment of our independent registered public accounting firm is considered a “routine” matter and, accordingly, a Nominee has discretionary authority to vote shares on such proposal. The election of directors and the approval of the amendments to our 2018 Performance-Based Stock Incentive Plan and performance-based stock options are considered “non-routine” matters and, accordingly, a Nominee does not have discretionary authority to vote shares on such proposals.

Vote Required

A quorum at the annual meeting is required for the approval of any of the proposals set forth herein. Directors will be elected by a plurality of the votes cast on the election of directors. The approval of the amendments to our 2018 Performance-Based Stock Incentive Plan and the Performance Awards (as defined in Proposal Three beginning on page 35) requires (1) the affirmative vote of the holders of a majority of the total votes of shares of our common stock cast in person or by proxy at the annual meeting, pursuant to the rules of NASDAQ and our Bylaws, and (2) the affirmative vote of the holders of a majority of the total votes of shares of our common stock cast in person or by proxy at the annual meeting other than shares of our common stock owned, directly or indirectly, by Chad Steelberg or Ryan Steelberg and their affiliates cast in person or by proxy at the annual meeting, pursuant to the resolutions of our Board and the Compensation Committee approving such amendments. The approval of other proposals to be considered at the annual meeting requires the affirmative vote of the holders of a majority of the total votes of shares of our common stock cast at the annual meeting in person or by proxy.

Voting of Proxies

Stockholders may vote by proxy or in person at the annual meeting. To vote by proxy, stockholders may vote by Internet, telephone or mail. The instructions and information needed to access our proxy materials and vote by Internet can be found in the proxy card.

If you are the beneficial owner of shares held by a Nominee, then your Nominee, as the record owner of the shares, must vote those shares in accordance with your instructions. Please refer to the voting instruction form that your Nominee makes available to you for voting your shares.

Two of our officers, Peter F. Collins and Jeffrey B. Coyne, have been designated by our Board as proxies for voting on matters brought before the annual meeting. Each proxy properly received by us prior to the annual meeting, and not revoked, will be voted in accordance with the instructions given in the proxy. If a choice is not specified in the proxy, the proxy will be voted (i) FOR the election of the director nominees listed therein; (ii) FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and (iii) FOR the approval of the amendments to our 2018 Performance-Based Stock Incentive Plan and performance-based stock options.

Revoking a Proxy

Any proxy may be revoked or superseded by giving notice of revocation in writing prior to the commencement of the annual meeting, by executing and delivering a later proxy prior to the commencement of the annual meeting, or by voting at the annual meeting. Attendance at the annual meeting will not in and of itself constitute revocation of a submitted proxy. Any written notice revoking a proxy should be sent to our Secretary at our corporate offices at 575 Anton Boulevard, Suite 100, Costa Mesa, CA 92626, and must be received prior to the commencement of the annual meeting.

If your shares are held in the name of a Nominee, you may change your vote by submitting new voting instructions to your Nominee. Please contact your Nominee for further instructions on changing your vote.

Stockholder Proposals

Any stockholder desiring to submit a proposal for action at our 2021 annual meeting of stockholders and presentation in our proxy statement for such meeting should deliver the proposal to us at our corporate offices no later than February 25, 2021 in order to be considered for inclusion in our proxy statement relating to that meeting in accordance with Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Matters pertaining to proposals, including the number and length thereof, eligibility of persons entitled to have such proposals included in the proxy statement and other aspects are covered by Rule 14a-8 and other laws and regulations, to which interested persons should refer.

3

In addition, under our amended and restated bylaws (“Bylaws”), any stockholder who is entitled to vote at a meeting of stockholders and who intends to propose business at such meeting must provide timely written notice to our Secretary. To be timely, a stockholder’s written notice must be received by our Secretary at our principal executive offices no later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the one-year anniversary of our annual meeting. As a result, any notice given by a stockholder pursuant to the provisions of our Bylaws in connection with our 2021 annual meeting of stockholders must be received no earlier than March 26, 2021 and no later than April 25, 2021. However, if our 2021 annual meeting occurs more than thirty (30) days before or more than sixty (60) days after July 24, 2021, in order to be timely, notice by the stockholder must be received by our Secretary no later than the close of business on the later of the ninetieth (90th) day prior to the scheduled date of our 2021 annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made.

Such notice must set forth as to each matter that the stockholder proposes to bring before any meeting of stockholders: (1) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting; (2) the name and record address of the stockholder giving such notice, and the names and addresses of the beneficial owner(s), if different, on whose behalf the business proposed to be brought before a meeting of stockholders is made (collectively, the “Proposing Person(s)”); (3) certain information regarding the ownership interests of each such Proposing Person, or any of its affiliates or associates, in our securities; (4) any material interest of each such Proposing Person in such business; and (5) certain other information required to be included in any such notice, as described in Article I, Section 2(a)(2) of our Bylaws, including, but not limited to, information regarding any transactions, agreements or arrangements giving the Proposing Persons other interests in or related to our capital stock, or any agreements, arrangements or understandings by and among the Proposing Persons and any other person pertaining to the business proposed to be brought before the annual meeting. Stockholders providing notice of proposed business to be brought before an annual meeting must also follow the procedures set forth in our Bylaws pertaining to updates and supplements to the information contained in such notice.

Rule 14a-4 promulgated under the Exchange Act governs our use of our discretionary proxy voting authority with respect to a stockholder proposal that is not addressed in our proxy statement. Such rule provides that if a proponent of a proposal fails to notify us with respect to such proposal at least 45 days prior to the current year’s anniversary of the date of mailing of the prior year’s proxy statement, then we will be allowed to use our discretionary voting authority when the proposal is raised at the annual meeting, without any discussion of the matter in the proxy statement. We anticipate that our next annual meeting of stockholders will be held in June 2021. If we do not receive any stockholder proposals for our 2021 annual meeting in accordance with the requirements of Rule 14a-4(c)(1) promulgated under the Exchange Act, we will be able to use our discretionary voting authority as outlined above. In addition, if the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal.

Other Matters

Management is not aware of any other matters that will be presented for consideration at our annual meeting.

Veritone Corporate Office

Our corporate offices are located at 575 Anton Boulevard, Suite 100, Costa Mesa, California 92626.

4

Election of Directors

Board of Directors

The size of our Board is currently fixed at seven directors. There are currently seven directors serving on our Board with no vacancies. Our Board is divided into three classes, with each director serving a three-year term, and one class being elected at each year’s annual meeting of stockholders. Class I consists of two directors, Class II consists of two directors, and Class III consists of three directors. The terms of our current Class III directors will expire at our 2020 annual meeting. Our Class I directors will continue to serve until our annual meeting in 2021, and our Class II directors will continue to serve until our annual meeting in 2022.

Our amended and restated certificate of incorporation provides that the number of directors of our company will be fixed solely and exclusively by resolution duly adopted from time to time by our Board. Any additional directorships resulting from an increase in the number of directors may only be filled by the directors then in office unless otherwise required by law or by a resolution passed by our Board. The term of office for each director will be until his or her successor is elected at an annual meeting of stockholders or his or her death, resignation or removal, whichever is earliest to occur.

Director Nominees

Based upon the recommendation of our Corporate Governance and Nominating Committee, our Board has nominated the individuals set forth below to serve as Class III directors until our annual meeting of stockholders in 2023. Each nominee is currently serving on our Board.

|

Name |

|

Principal Occupation |

|

Age |

|

Director Since |

|

|

|

|

|

|

|

|

|

G. Louis Graziadio, III |

|

President and Chief Executive Officer, Second Southern Corp. |

|

70 |

|

2016 |

|

|

|

|

|

|

|

|

|

Chad Steelberg |

|

Chairman of the Board and Chief Executive Officer, Veritone, Inc. |

|

49 |

|

2014 |

|

|

|

|

|

|

|

|

|

Ryan Steelberg |

|

President, Veritone, Inc. |

|

46 |

|

2014 |

G. Louis Graziadio, III has served as our director since August 2016. Since March 1990, Mr. Graziadio has been President and Chief Executive Officer of Second Southern Corp., the managing partner of Ginarra Partners, L.L.C., a closely-held company involved in a wide range of investments and business ventures. Mr. Graziadio is also Chairman of the Board and Chief Executive Officer of Boss Holdings, Inc., a distributor of consumer goods. From August 2016 to June 2018, Mr. Graziadio served as the Executive Chairman of Acacia Research Corporation (“Acacia”), a leading patent licensing firm. From 1984 to 2000, Mr. Graziadio served as a director of Imperial Bancorp, the parent company of Imperial Bank, a Los Angeles-based commercial bank acquired by Comerica Bank in January 2001. Mr. Graziadio, and companies with which he is affiliated, are significant shareholders in numerous private and public companies in a number of different industries. Since 1978, Mr. Graziadio has been active in restructurings of both private and public companies, as well as corporate spin-offs and initial public offerings. Mr. Graziadio previously served as a director of True Religion Apparel, Inc., a publicly traded premium clothing company, from May 2005 until its sale in July 2013, and as a director of World Point Terminals, LP, a previously publicly traded company which owns, operates, develops, and acquires terminal assets relating to the storage of light refined products and crude oil, from August 2013 to August 2017. In addition, Mr. Graziadio is a member of the Pepperdine University Board and the Board of Visitors of the Graziadio School of Business and Management at Pepperdine University. He is also a founding member of the board of directors of the Los Angeles Fire Department Scholarship Fund. We believe that Mr. Graziadio is qualified to serve on our Board due to his extensive experience as a member of senior management at several different companies, as well as his expertise in the area of finance, investment and capital market transactions. In addition, his experience in serving on the boards of directors of public companies provides our Board with valuable skills and capabilities to help guide the governance of our company.

5

Chad Steelberg is a co-founder of our company and has served as our Chief Executive Officer and Chairman of the Board since our inception in June 2014. From January 2007 to December 2012, he served as a board member of Brand Affinity Technologies, Inc., a technology and marketing services company. Prior to that, Mr. Steelberg served as the general manager of the Audio Division of Google Inc. from February 2006 to February 2007. From February 2002 to February 2007, he was the co-founder and Chief Executive Officer of dMarc Broadcasting, an advertising company that was acquired by Google Inc. in 2006. Prior to that, Mr. Steelberg was the co-founder and Chief Executive Officer of Adforce, a publicly traded centralized independent ad-serving company that was acquired by CMGi in 1999. We believe that Mr. Steelberg is qualified to serve on our Board based on his long and successful track record in identifying new market opportunities and creating disruptive technology-based companies. In addition, Mr. Steelberg’s intimate knowledge of the day-to-day management and operations of our company provides our Board with an in-depth understanding of our company.

Ryan Steelberg is a co-founder of our company and has served as a director since our inception in June 2014 and as the President of our subsidiary, Veritone One, Inc., since June 2015. In March 2017, he was appointed as President of our company. From October 2007 to December 2014, he served as the President and Chief Executive Officer of Brand Affinity Technologies, Inc. Prior to that, Mr. Steelberg served as the Head of the Radio Division of Google Inc. from February 2006 to February 2007. From September 2002 to February 2007, he was the co-founder and President of dMarc Broadcasting, an advertising company that was acquired by Google Inc. in 2006. We believe that Mr. Steelberg is qualified to serve on our Board because of his extensive experience in the business development, marketing and management of enterprises in the media and digital technology industries. In addition, Mr. Steelberg’s intimate knowledge of our operations and technology provides our Board with an in-depth understanding of our company.

Unless otherwise instructed, each proxy received by us will be voted in favor of the election of the nominees named above as directors. The nominees have indicated that they are willing and able to serve as directors if elected. If any nominee should become unable or unwilling to serve, it is the intention of the persons designated as proxies to vote instead, in their discretion, for any such other person as may be designated as a nominee by our Board.

Our Board recommends a vote “FOR” the election of the nominees named in this proxy statement as directors.

Continuing Directors

The following directors will continue to serve on our Board:

|

Name |

|

Principal Occupation |

|

Age |

|

Class |

|

Term Expires |

|

Director Since |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jeff P. Gehl |

|

Managing Partner, RCP Advisors, LLC |

|

53 |

|

I |

|

2021 |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Knute P. Kurtz |

|

Independent Investor |

|

64 |

|

II |

|

2022 |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nayaki R. Nayyar |

|

President of Digital Service and Operations Management, BMC Software, Inc. |

|

49 |

|

II |

|

2022 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard H. Taketa |

|

President, Taketa Capital Corporation |

|

48 |

|

I |

|

2021 |

|

2019 |

Jeff P. Gehl has served as our director since May 2017. Since 2001, Mr. Gehl has been a Managing Partner of RCP Advisors, a private equity firm he co-founded. Mr. Gehl is responsible for leading RCP’s client relations and fund-raising activities, as well as its relationships with private equity fund managers in the Western United States, and he also serves as a member of the investment committees and advisory boards of various funds in which RCP is invested. Prior to co-founding RCP, he was involved in a number of private equity-financed companies, where he held senior positions in finance and operations. In addition, Mr. Gehl founded and served as Chairman and Chief Executive Officer of MMI, a technical staffing company, and acquired Big Ballot, Inc., a sports marketing firm. He also serves as a director of P10 Holdings, Inc., an asset management investment firm that is the parent company of RCP, and as a director of Super League Gaming, Inc., a leading amateur esports platform provider. Mr. Gehl received a Bachelor of Science degree in Business Administration from the University of Southern California’s Entrepreneur Program, where he received the “Entrepreneur of the Year” award in 1989. We believe that Mr. Gehl is qualified to serve on our Board based on his extensive experience in financing, developing and managing high-growth technology companies.

6

Knute P. Kurtz has served as our director since June 2017. Until his retirement in June 2016, Mr. Kurtz was the Managing Partner of the Orange County office of PricewaterhouseCoopers LLP (“PwC”). During his ten years in that role, Mr. Kurtz was responsible for leading all important market facing activities on behalf of PwC and overseeing the delivery of assurance, financial/tax and advisory services to public and private clients in the market. He was a member of PwC’s senior leadership for the Southern California, Phoenix and Las Vegas cluster of offices and also served as the Market Leader for PwC’s Private Company Services practice in that region. Prior to his role in the Southern California market, Mr. Kurtz served in various other leadership positions with PwC over a career that spanned 38 years and six offices throughout the United States. His professional experience includes serving as the lead advisor and audit partner to public and private clients in a number of different industry sectors and companies as diverse as Fortune 500 companies to high tech start-up entities. In addition to financial/audit services, he has extensive experience in capital market transactions including initial public offerings, mergers and acquisitions and debt offerings. His client work has also included advising audit committees and senior management on matters pertaining to corporate governance, risk assessments, internal controls and strategic initiatives. We believe that Mr. Kurtz is qualified to serve on our Board based on his extensive experience and knowledge in accounting and auditing matters involving publicly traded technology companies, which provide our Board with valuable insight in their oversight of our company in these areas.

Nayaki R. Nayyar has served as our director since October 2018. Since October 2016, Ms. Nayyar has served as President of Digital Service and Operations Management at BMC Software, Inc., a leading enterprise software solutions provider. Prior to joining BMC Software, Inc., Ms. Nayyar served as General Manager and Global Head of the Internet of Things (IoT) division of SAP SE, a leading provider of enterprise application software, from January 2016 to October 2016. She joined SAP SE in 2011, holding the positions of Senior Vice President, Corporate Strategy, from March 2011 to December 2011, and Senior Vice President, SAP Cloud, Customer Engagement, from January 2012 to December 2015. Ms. Nayyar also served as Vice President and Chief Technical Officer, Enterprise Architecture and Application Services, at Valero Energy Corporation, an international petroleum company, from August 2000 to February 2011. Ms. Nayyar currently serves on the board of directors of Corteva, Inc., a publicly traded agriculture company. We believe that Ms. Nayyar is qualified to serve on our Board due to her technical expertise in enterprise cloud software and IoT technologies, and her extensive experience in leading large teams in complex global organizations through acquisitions, technology transitions and growth phases, which provide valuable insight to our Board with respect to our technology and growth strategies.

Richard H. Taketa has served as our director since May 2019. Since September 2018, Mr. Taketa has been President of Taketa Capital Corporation, a private equity investment and consulting company. Previously, he served as President and Chief Executive Officer of York Risk Services, Inc. (“York”), a leading provider of technology-enabled, integrated insurance services to the property and casualty insurance industry, from January 2014 to September 2018, and served as Chairman of York’s board of directors from October 2014 to July 2017. Prior to becoming CEO at York, Mr. Taketa served in a variety of capacities including as the President of Commercial Business, Chief Operating Officer and Chief Strategy Officer. Mr. Taketa joined York in 2006 upon its acquisition of Southern California Risk Management Associates, a regional provider of third-party administration services to insurance companies, where he had served as Chief Executive Officer since 2004. Prior to that, he was a co-founder and managing director of Eventide Capital, a small private equity firm, after working as a corporate securities lawyer with DLA, a global law firm and in various public policy roles with non-governmental organizations in Washington, D.C. Mr. Taketa currently serves on the board of directors of Palomar Holdings, Inc., a publicly traded provider of property catastrophe insurance, and has also served on the boards of directors of several privately-held companies. He was named an Ernst & Young’s Entrepreneur of the Year in 2017 for the State of New Jersey. He has been a recurring guest lecturer at the Stanford Graduate School of Business and is a member of the California Bar Association, inactive status. Mr. Taketa holds a Bachelor of Arts degree from Colgate University and a law degree from Stanford Law School. We believe that Mr. Taketa is qualified to serve on our Board based on his extensive experience in financing, developing and managing high-growth, technology-enabled companies, as well as his experience in the insurance and healthcare industries, corporate law and governance, mergers and acquisitions, public policy, and operating in regulated markets.

7

Mr. Gehl currently serves on the boards of directors of two other publicly reporting companies, P10 Holdings, Inc. and Super League Gaming, Inc. Mr. Gehl does not currently serve, and during the past five years has not served, on the board of directors of any other publicly reporting company or investment company.

Mr. Graziadio previously served on the boards of directors of two other publicly reporting companies, Acacia until June 2018, and World Point Terminals, LP until August 2017. Mr. Graziadio does not currently serve, and during the past five years has not served, on the board of directors of any other publicly reporting company or investment company.

Ms. Nayyar currently serves on the board of directors of one other publicly reporting company, Corteva, Inc. Ms. Nayyar does not currently serve, and during the past five years has not served, on the board of directors of any other publicly reporting company or investment company.

Mr. Taketa currently serves on the board of directors of one other publicly reporting company, Palomar Holdings, Inc. Mr. Taketa previously served on the board of directors of one other publicly reporting company, York Risk Services Holding Corp., until September 2018. Mr. Taketa does not currently serve, and during the past five years has not served, on the board of directors of any other publicly reporting company or investment company.

No other director currently serves, or during the past five years has served, on the board of directors of any other publicly reporting company or investment company.

Corporate Governance

Board Independence

Our Board has determined that five of our seven current directors, Ms. Nayyar and Messrs. Gehl, Graziadio, Kurtz and Taketa, are independent, as determined in accordance with the rules of NASDAQ and the SEC. Nathaniel L. Checketts and Christopher J. Oates, who served on our Board until May 2019 and June 2019, respectively, were also determined by the Board to be independent in accordance with such rules. In making such independence determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances that the Board deemed relevant in determining their independence.

Board Leadership Structure

Chad Steelberg, our Chief Executive Officer, serves as our Chairman of the Board. The Chairman has authority, among other things, to preside over Board meetings and set the agenda for Board meetings. Accordingly, the Chairman has substantial ability to shape the work of our Board. We currently believe that the combination of the roles of Chairman and Chief Executive Officer is appropriate for our business and affairs. Mr. Steelberg has extensive knowledge and experience in the management and operation of software and digital media companies, and an in-depth understanding of our business strategies and day-to-day operations, which make him well suited to set the agenda and lead the discussions at Board meetings as the Chairman. This also facilitates communications between our Board and management by ensuring a regular flow of information, thereby enhancing our Board’s ability to make informed decisions on critical issues facing our company. However, no single leadership model is right for all companies and at all times. Our Board recognizes that depending on the circumstances, other leadership models, such as the appointment of a lead independent director, might be appropriate. Accordingly, our Board may periodically review its leadership structure.

Board Role in Risk Management

Management continually monitors the material risks we face, including financial risk, strategic risk, enterprise and operational risk and legal and compliance risk. The Board is responsible for exercising oversight of management’s identification and management of, and planning for, those risks. In fulfilling this oversight role, our Board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. Our Board performs these functions in a number of ways, including the following:

|

|

• |

at its regularly scheduled meetings, the Board receives management updates on our business operations, financial results, committee activities, and strategy and discusses risks related to the business; |

8

|

|

• |

the Compensation Committee assists the Board by evaluating potential risks related to our compensation programs; and |

|

|

• |

through management updates and committee reports, the Board monitors our risk management activities, including the enterprise risk management process and cybersecurity risks, risks relating to our compensation programs, and financial, legal and operational risks. |

Meetings

It is the policy of our Board to hold at least four regular, in-person meetings each year, typically one in each calendar quarter. In addition, our Board holds special meetings as and when deemed necessary by the directors.

Our Board held six meetings (including telephonic meetings) during the year ended December 31, 2019. Each director attended more than seventy-five percent of the aggregate of the number of meetings of our Board (held during the period in which he or she served as a director) and the total number of meetings held by all committees of our Board on which he or she served (held during the period in which he or she served on such committees).

We have not adopted a formal policy regarding attendance by members of our Board at our annual meetings of stockholders; however, generally, we expect that all directors will attend such meetings. With the exception of Mr. Kurtz and Paul A. Krieger (who served on our Board until June 2019), all of our directors who were serving at the time of our 2019 annual meeting of stockholders attended such meeting.

Private Sessions

Our independent directors meet privately, without management present, at least four times during the year. These private sessions are generally held in conjunction with the regular quarterly Board meetings. Other private meetings are held as often as deemed necessary by the independent directors.

Committees of Our Board

Our Board has three separate standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. Each committee operates under a written charter adopted and reviewed annually by our Board, which satisfy the applicable standards of the SEC and NASDAQ. Copies of the charters of all standing committees are available on our website at investors.veritone.com under “Governance.” We will also provide electronic or paper copies of the standing committee charters free of charge, upon request made to our Secretary. Our Board may establish other committees from time to time as deemed appropriate by our Board based on the needs of our Board and the company.

Audit Committee

Our Audit Committee consists of Messrs. Graziadio, Kurtz and Taketa, and Mr. Kurtz serves as the Chairman. Messrs. Checketts and Oates served on our Audit Committee until they resigned from the Board in May 2019 and June 2019, respectively. Our Board has affirmatively determined that each member serving on the Audit Committee currently or during 2019 meets the definition of an “independent director” for purposes of serving on an audit committee under Rule 10A-3 of the Exchange Act and NASDAQ rules. In addition, our Board has determined that each of Messrs. Graziadio, Kurtz and Taketa qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. Each member of the Audit Committee will be financially literate at the time such member is appointed. The Audit Committee held nine meetings (including telephonic meetings) during the year ended December 31, 2019.

Our Audit Committee has the responsibility to, among other things:

|

|

• |

review and evaluate our annual and quarterly financial statements and reports, and discuss these statements and reports with our independent registered public accounting firm and management; |

|

|

• |

assess the independence and qualifications of, appoint and, where appropriate, replace our independent registered public accounting firm; |

9

|

|

• |

review the proposed scope and results of the audit, and serve as the primary point of contact with our independent registered public accounting firm through the audit process with respect to key audit matters; |

|

|

• |

review and pre-approve audit and non-audit fees and services; |

|

|

• |

review accounting and financial controls with our independent registered public accounting firm and our financial and accounting staff, and oversee any the process of addressing any issues that arise with respect to the scope, adequacy and effectiveness of these controls; |

|

|

• |

assess and oversee the implementation of new accounting standards with our independent registered public accounting firm; |

|

|

• |

review and approve transactions between us and our directors, officers and affiliates; |

|

|

• |

recognize and prevent prohibited non-audit services; |

|

|

• |

establish procedures for complaints received by us regarding accounting matters; |

|

|

• |

oversee internal audit functions; and |

|

|

• |

review and evaluate our primary risk exposures. |

Compensation Committee

Our Compensation Committee consists of Ms. Nayyar and Messrs. Gehl and Taketa, and Mr. Taketa serves as the Chairman. Messrs. Checketts and Oates served on our Compensation Committee until May 2019 and June 2019, respectively. Our Board has determined that each member serving on the Compensation Committee currently or during 2019 is “independent” as that term is defined in the applicable SEC and NASDAQ rules. The Compensation Committee held four meetings (including telephonic meetings) during the year ended December 31, 2019.

Our Compensation Committee has the responsibility to, among other things:

|

|

• |

review and determine the compensation arrangements for our executive officers; |

|

|

• |

establish and review general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; |

|

|

• |

administer our stock incentive and purchase plans; |

|

|

• |

evaluate the performance of our Chief Executive Officer and participate in the evaluation of other executive management; |

|

|

• |

evaluate and make recommendations to our Board regarding the compensation of our Board and its committees; |

|

|

• |

evaluates the potential risks related to our compensation programs; and |

|

|

• |

review the independence of any compensation advisers engaged by our Compensation Committee. |

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee consists of Messrs. Gehl, Graziadio and Kurtz, and Mr. Gehl serves as the Chairman. Messrs. Checketts and Oates served on our Corporate Governance and Nominating Committee until May 2019 and June 2019, respectively. Our Board has determined that each member serving on the Corporate Governance and Nominating Committee currently or during 2019 is “independent” as that term is defined in the applicable NASDAQ rules. The Corporate Governance and Nominating Committee held four meetings during the year ended December 31, 2019.

Our Corporate Governance and Nominating Committee has the responsibility to, among other things:

|

|

• |

identify, evaluate and make recommendations to our Board regarding prospective director nominees; |

|

|

• |

oversee the evaluation of our Board and its committees; |

|

|

• |

review developments in corporate governance practices; |

10

|

|

• |

develop, periodically review and make recommendations to our Board regarding corporate governance guidelines and matters. |

Identifying and Evaluating Director Candidates

Our Corporate Governance and Nominating Committee evaluates and recommends director candidates for nomination by the full Board. Any stockholder may recommend candidates for evaluation by the Corporate Governance and Nominating Committee by submitting a written recommendation to our Secretary in accordance with the requirements described under the heading “Stockholder Nominations” below.

There are no specific minimum qualifications that the Corporate Governance and Nominating Committee requires to be met by a director nominee recommended for a position on our Board, nor are there any specific qualities or skills that are necessary for one or more members of our Board to possess, other than as are necessary to meet the requirements of the laws, rules and regulations applicable to us. Except as required by applicable law, our Board does not have a formal policy regarding racial/ethnic, gender or other diversity characteristics of director candidates, but considers diversity as a factor in evaluating such candidates.

Our corporate headquarters are located in Costa Mesa, California and, as such, we are subject to the requirements of Section 301.3 of the California Corporations Code, which provide that (i) currently, we must have a minimum of one female director on our Board, and (ii) based on the current size of our Board, we must have a minimum of three female directors on our Board by the end of 2021. The Corporate Governance and Nominating Committee will take these requirements into account in evaluating and recommending director candidates for nomination to the Board.

The Corporate Governance and Nominating Committee will evaluate any director candidates recommended by stockholders in the same manner as it would evaluate any other candidates identified by or recommended to the committee.

Stockholder Nominations

In accordance with our Bylaws, stockholders may nominate a candidate for election as director by following the procedures described in the section entitled “Stockholder Proposals” on page 3, including delivery of a written notice to our Secretary within the time periods and containing the information specified in that section. In addition, any notice relating to one or more director nominations must set forth as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act. Any such notice must be accompanied by such person’s written consent to be named in the proxy statement as a nominee and to serving as a director if elected. If the Corporate Governance and Nominating Committee or our Board determines that any nomination made by a stockholder was not made in accordance with the foregoing procedures, the rules and regulations of the SEC or other applicable laws or regulations, such nomination will be void.

Communications with Our Board

Any stockholder may communicate with our Board, any Board committee or any individual director. All communications should be made in writing, addressed to our Board, our Board committee or the individual director, as the case may be, in care of our Secretary, mailed or delivered to our corporate offices at 575 Anton Boulevard, Suite 100, Costa Mesa, California 92626. Our Secretary will forward or otherwise relay all such communications to the intended recipient(s).

11

Code of Ethics

Our Board has adopted a code of business conduct and ethics, which is applicable to our principal executive, financial and accounting officers and all persons performing similar functions. A copy of that code is available in the Investors section of our principal corporate website at investors.veritone.com under the heading “Governance.” We will also provide an electronic or paper copy of the code of ethics, free of charge, upon request made to our Secretary. If any substantive amendments are made to the written code of ethics, or if any waiver (including any implicit waiver) is granted from any provision of the code of ethics to our principal executive, financial and accounting officers, we will disclose the nature of such amendment or waiver on our website at www.veritone.com or, if required, in a current report on Form 8-K.

Procedures for Submitting Complaints Regarding Accounting and Auditing Matters

We are committed to compliance with all applicable securities laws and regulations, accounting standards and accounting controls. The Audit Committee has established written procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by our employees of concerns or complaints regarding such matters. The Audit Committee oversees the handling of such concerns or complaints. Any person may report concerns or complaints regarding accounting, internal accounting controls or auditing matters by sending a communication in writing addressed to the Audit Committee, in care of our General Counsel, mailed or delivered to our corporate offices at 575 Anton Boulevard, Suite 100, Costa Mesa, California 92626. Our General Counsel will forward such communication to the Chairman of the Audit Committee. Additional information regarding the procedures for non-employees to submit such concerns or complaints is available in the Investors section of our website at investors.veritone.com under the heading “Governance.”

Executive Officers

We currently have four executive officers who serve at the pleasure of our Board and are elected on an annual basis:

|

Name |

|

Age |

|

Title |

|

|

|

|

|

|

|

Chad Steelberg |

|

49 |

|

Chief Executive Officer and Chairman of the Board |

|

Ryan Steelberg |

|

46 |

|

President |

|

Peter F. Collins |

|

55 |

|

Executive Vice President and Chief Financial Officer |

|

Jeffrey B. Coyne |

|

54 |

|

Executive Vice President, General Counsel and Secretary |

The biographies of Chad Steelberg and Ryan Steelberg are presented on page 6. The biographies of our other executive officers are set forth below.

Peter F. Collins has served as our Executive Vice President and Chief Financial Officer since May 2017 and previously as our Senior Vice President and Chief Financial Officer from October 2016 to May 2017. From May 2014 to October 2016, Mr. Collins served as Chief Financial Officer at J Brand Holdings, LLC, a premium clothing company and a subsidiary of Fast Retailing Co., Ltd. From March 2007 to July 2013, Mr. Collins served as Chief Financial Officer of True Religion Apparel Inc., a publicly traded premium clothing company. From April 2004 to March 2007, he served as Divisional Vice President, Corporate Controller and Principal Accounting Officer for Nordstrom, Inc., a publicly traded department store chain. From 2002 to 2004, Mr. Collins served in various financial roles with Albertson’s, Inc., a supermarket chain, including Group Vice President and Controller. Prior to that, from 1998 until 2002, Mr. Collins was a partner with Arthur Andersen LLP, serving clients in the healthcare, retail, distribution and manufacturing industries.

12

Jeffrey B. Coyne has served as our Executive Vice President, General Counsel and Secretary since October 2016. From July 2004 to April 2016, Mr. Coyne served as Senior Vice President, General Counsel and Corporate Secretary, with responsibility for legal affairs and human resources, at Newport Corporation, a global supplier of advanced technology products that was acquired by MKS Instruments, Inc., and from June 2001 to July 2004, he served as Vice President, General Counsel and Corporate Secretary of Newport Corporation. Prior to that, Mr. Coyne was a partner in the Corporate and Securities Law Department of Stradling Yocca Carlson & Rauth, P.C. from January 2000 to June 2001, and was an associate attorney at such firm from February 1994 to December 1999. From November 1991 to February 1994, Mr. Coyne was an associate attorney at Pillsbury Madison & Sutro LLP (now Pillsbury Winthrop Shaw Pittman LLP), an international law firm. Mr. Coyne is a member of the State Bar of California.

Family Relationships

There are no family relationships between any director, executive officer or person nominated or chosen to become a director or executive officer, except that Chad Steelberg and Ryan Steelberg are brothers.

Legal Proceedings

On December 15, 2014, Brand Affinity Technologies, Inc. filed a petition for relief under the Bankruptcy Code commencing the matter of In re Brand Affinity Technologies, Inc., United States Bankruptcy Court for the Central District of California, Santa Ana Division, Case No. 8:14-bk-17244 SC. Chad Steelberg and Ryan Steelberg previously served as officers, directors and beneficial owners of Brand Affinity Technologies, Inc. The Bankruptcy Court entered an order closing this bankruptcy case on December 5, 2016.

Executive Compensation

The following is a summary of the compensation policies, plans and arrangements that were in effect for our executive officers during 2018 and 2019. This summary should be read in conjunction with the Summary Compensation Table and related disclosures set forth below. We are eligible to, and have chosen to, comply with the executive compensation disclosure rules applicable to a “smaller reporting company,” as defined in applicable SEC rules.

We have entered into new employment agreements with Chad Steelberg and Ryan Steelberg effective as of June 15, 2020, which are discussed under the heading “2020 Employment Agreements with Chad Steelberg and Ryan Steelberg” beginning on page 18. The compensation arrangements set forth in these new employment agreements will replace and supersede the compensation plans and arrangements discussed in this summary with respect to Chad Steelberg and Ryan Steelberg.

Overview

Our executive compensation plans and arrangements are overseen and administered by our Compensation Committee, which is comprised entirely of independent directors as determined in accordance with applicable NASDAQ and SEC rules. The Compensation Committee operates under a written charter adopted and reviewed annually by our Board. A copy of this charter is available on our website at investors.veritone.com under the heading “Governance.”

Our Compensation Committee has established an executive compensation program that is intended to fulfill three primary objectives: first, to attract and retain the high caliber executives required for the success of our business; second, to reward these executives for strong financial and operating performance; and third, to align their interests with those of our stockholders to incentivize them to create long-term stockholder value. The key components of this executive compensation program are base salaries, cash incentives, and equity awards, as discussed in more detail below.

13

In December 2017, the Compensation Committee engaged a compensation consultant, Pearl Meyer & Partners, LLC (“Pearl Meyer”), to conduct a market study of executive compensation and make recommendations regarding the base salaries, cash incentive compensation and equity compensation for our executive officers. Pearl Meyer reviewed compensation data reported by a group of publicly traded software-as-a-service companies with annual revenues between $50 million and $150 million, with average revenues of approximately $100 million. The Compensation Committee determined that this group of companies, which has higher revenues than Veritone, was an appropriate peer group for this analysis, as it represented the size of companies with which we compete for executive talent. Specifically, Pearl Meyer reviewed base salaries, target cash incentives and annual equity compensation for the companies in this group, and provided recommendations to the Compensation Committee. In November 2018, Pearl Meyer provided updates to this market data and its recommendations, based on general trend data.

The Compensation Committee reviewed the market data and recommendations that had been provided by Pearl Meyer in 2017, and used such data and recommendations to establish compensation levels and plans for our executive officers for 2018. The Compensation Committee also considered such market data and recommendations, and the updates thereto provided by Pearl Meyer in November 2018, in its review of compensation of our executive officers for 2019. Such market data indicated that the target total cash compensation and target total direct compensation of our executive officers were both significantly below the 50th percentile of the peer group.

As part of its review of executive compensation in 2018, the Compensation Committee also discussed with Pearl Meyer whether it would be in the best interests of Veritone and our stockholders to develop a separate performance-based equity incentive program for our Chief Executive Officer, our President, and our other executive officers and employees, to provide them with an additional incentive to drive increases in stockholder value. The Compensation Committee determined that such a program would tie a large portion of each participant’s total earnings potential to the achievement of challenging stockholder value targets, which would give them a powerful incentive to drive increases in stockholder value and strongly align their interests with the interests of our stockholders. Due to the potential interests of Chad Steelberg and Ryan Steelberg in such program, on the recommendation of the Compensation Committee, the Board appointed a special committee comprised of independent and disinterested members of the Board (the “Special Committee”), which had the exclusive authority to develop and negotiate such performance-based equity incentive program on behalf of our Board. In May 2018, our Board approved our 2018 Performance-Based Stock Incentive Plan (the “2018 Plan”) and the Special Committee approved awards of performance-based stock options to Chad Steelberg and Ryan Steelberg, subject to stockholder approval, which was received in June 2018. The 2018 Plan and the awards of performance-based stock options under that plan in 2018 and 2019 are discussed in more detail under the heading “2018 Performance-Based Stock Incentive Plan” below. In June 2020, the Compensation Committee and the disinterested members of our Board approved certain amendments to the 2018 Plan and the performance-based stock options granted to our executive officers and other employees, subject to stockholder approval, as discussed in more detail under the heading “Amendments to Performance-Based Stock Options” below.

Base Salaries

In November 2018, the Compensation Committee reviewed the base salaries of our executive officers, taking into consideration the market data and recommendations received from Pearl Meyer as discussed above, and determined that no changes would be made to base salaries for 2019. Accordingly, the annual base salary of each executive officer for 2019 was set at $250,000, which was the same amount that had been established by the Compensation Committee effective as of March 2018.

Cash Incentives

The Compensation Committee established a cash incentive program for our executive officers to link a significant portion of each executive’s total compensation to the achievement of pre-established financial performance goals. Under the cash incentive program, a target incentive amount is established for each executive officer for each year. The Compensation Committee establishes target and maximum levels for each financial measure, with the target level corresponding to the level for such measure reflected in our annual operating plan and the maximum level reflecting significant overachievement of the target level. Achievement of the target level for a measure results in a payout of 100% of the target incentive amount tied to that financial measure, and achievement of the maximum level for such measure results in a payout of 200% of the target incentive for such measure. Payouts are prorated on a straight-line basis in the event of achievement between the target and maximum levels for the applicable financial measure.

14

For 2019, the Compensation Committee set each executive officer’s target cash incentive at $75,000 (30% of base salary). Payouts of the cash incentives for all executive officers were conditioned upon achievement of the targets set forth in the annual operating plan approved by our Board for 2019 for two financial measures, weighted equally, as follows: (i) net revenues of $61.7 million, and (ii) earnings (loss) before interest expense, depreciation, amortization and stock-based compensation expenses, adjusted to exclude certain acquisition, integration and financing-related costs (“Adjusted EBITDAS”) of a loss of $30.4 million.

Our net revenues for 2019 were $49.6 million, and our Adjusted EBITDAS for 2019 was a loss of $36.2 million. As a result, we did not achieve the target level for either of the financial measures established under the cash incentive program for 2019, and no cash incentives were earned by our executive officers for 2019.

Adjusted EBITDAS is a non-GAAP measure. An explanation of Adjusted EBITDAS and a reconciliation of this non-GAAP measure to our net loss calculated in accordance with GAAP for 2019 is included under the heading “Non-GAAP Financial Measure” in Part II, Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

Equity Incentives

We provide long-term incentive compensation to our executive officers through equity-based awards under our stock incentive plans, such as stock options, restricted stock and restricted stock units.

2014 Plan and 2017 Plan

Our 2014 Stock Option/Stock Issuance Plan (the “2014 Plan”) was approved by our Board and stockholders in 2014, and our 2017 Stock Incentive Plan (the “2017 Plan”) was approved by our Board and stockholders at the time of our initial public offering (“IPO”) in May 2017. Under these plans, the Compensation Committee or our Board has authority to grant awards of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock and/or restricted stock units to our executive officers, directors, employees and consultants. Our Board resolved not to make any further awards under the 2014 Plan following the completion of our IPO. The 2014 Plan will continue to govern all outstanding awards granted thereunder.

All stock options granted under the 2014 Plan and 2017 Plan have exercise prices equal to or greater than the fair market value of our common stock on the grant date, and expire 10 years after the grant date, subject to earlier expiration in the event of termination of the awardee’s continuous service with the company. All equity awards granted under the 2014 Plan and 2017 Plan vest in accordance with the vesting schedules established by the Compensation Committee at the time of award, subject to the awardee’s continued service with our company. The vesting of equity awards granted to our executive officers is subject to acceleration under certain circumstances as discussed under the heading “Payments Upon Termination of Employment or Change in Control” below.

In February 2019, the Compensation Committee granted equity awards to each of Messrs. Collins and Coyne under the 2017 Plan, consisting of stock options and restricted stock units. Each of Messrs. Collins and Coyne received a nonqualified option to purchase 15,000 shares of our common stock, which has an exercise price of $5.65 and had a grant date fair value of approximately $53,000 (determined using the Black-Scholes-Merton option pricing model). Such options vest over a four-year period, with 25% of the shares underlying such options vesting on the first anniversary of the grant date, and the remaining shares underlying such options vesting in 36 equal monthly installments thereafter, subject to acceleration under certain circumstances as discussed under the heading “Payments Upon Termination of Employment or Change in Control” below. In addition, each of Messrs. Collins and Coyne received an award of restricted stock units representing the right to receive upon vesting 16,845 shares of our common stock, which had a total grant date value of approximately $95,000 based on the closing stock price of our common stock on the grant date. Such restricted stock units vested in full in January 2020.

The Compensation Committee did not grant equity awards to Chad Steelberg or Ryan Steelberg in 2019 in light of the performance-based stock options awarded to them in 2018 under the 2018 Plan, as discussed below.

15

2018 Performance-Based Stock Incentive Plan

The following is a summary of our 2018 Plan and the awards of performance-based stock options that were made to our named executive officers under the 2018 Plan in 2018 and 2019. See the section entitled “Amendments to Performance-Based Stock Options” below for a discussion regarding certain amendments to such awards that were approved by the Compensation Committee and the disinterested members of our Board on June 12, 2020, subject to approval by our stockholders.

In May 2018, our Board approved our 2018 Plan, and the Special Committee approved awards of performance-based stock options to Chad Steelberg (the “CEO Award”) and Ryan Steelberg (the “President Award”) under the 2018 Plan. The CEO Award, President Award and 2018 Plan were approved by our stockholders in June 2018.

The CEO Award, the President Award and all awards granted to our other executive officers and employees under the 2018 Plan are 100% performance-based, vesting only upon the achievement of stock price targets that would represent significant increases in our stock price. All awards granted under the 2018 Plan consist of nonstatutory stock options, which will become exercisable in three equal tranches only if we achieve the following stock price goals:

|

Tranche |

|

Stock Price Goal |

|

1 |

|

$49.15 per share |

|

2 |

|

$98.31 per share |

|

3 |

|

$196.62 per share |

Each tranche will be determined to be achieved if our stock price equals or exceeds the applicable stock price goal for thirty consecutive trading days (each, a “Stock Price Milestone”). All stock options granted under the 2018 Plan have exercise prices equal to or greater than the fair market value of our common stock on the grant date, and expire 10 years after the grant date, subject to earlier expiration in the event of termination of an awardee’s service with the company.

The numbers of shares of common stock underlying the CEO Award and the President Award are 1,809,900 and 1,357,425, respectively, and the exercise price of such awards is $21.25 per share, which was the closing price of our common stock on May 4, 2018, the last trading day prior to the date of approval of the awards by the Special Committee (which was not a trading day). The vesting of the CEO Award is contingent upon Chad Steelberg being employed as our Chief Executive Officer, and the vesting of the President Award is contingent upon Ryan Steelberg being employed as President or in such other position as may be approved by the Compensation Committee. If Chad Steelberg’s service as Chief Executive Officer, or if Ryan Steelberg’s service as President (or such other position), is terminated by us (other than for misconduct), any outstanding and unexercisable portion of the award held by him will remain outstanding and eligible to become exercisable for a period of nine months following such termination (or until the expiration date of the award, if earlier). At that time, any portion of his award that has not become exercisable will be forfeited. The CEO Award and the President Award provide that any shares issued upon exercise thereof must be held by the executive officer for a minimum of six months, to further align the executive officer’s interests with the interests of our other stockholders following the exercise of such options.

On February 12, 2019, the Compensation Committee granted to each of Messrs. Collins and Coyne an option to purchase 26,001 shares of our common stock under the 2018 Plan. Such stock options have an exercise price of $5.65 per share, which was the closing price of our common stock on the grant date. The vesting of each such award is contingent upon the executive officer remaining employed by us. If the executive officer is terminated by us (other than for misconduct), any outstanding and unexercisable portion of the award held by him will remain outstanding and eligible to become exercisable for a period of nine months following such termination (or until the expiration date of the award, if earlier). At that time, any portion of his award that has not become exercisable will be forfeited.

We have utilized substantially all of the shares available for grant under the 2018 Plan. No awards will be granted under the 2018 Plan in the future.

16

Amendments to Performance-Based Stock Options

Due to the significant decline in our stock price since the adoption of the 2018 Plan, the Compensation Committee has determined that the 2018 Plan is not achieving its intended goals. On June 12, 2020, the Compensation Committee, and the disinterested members of our Board, authorized, subject to stockholder approval, certain amendments to the 2018 Plan, the stock option award agreements evidencing awards under the 2018 Plan (including the CEO Award, the President Award and the awards to Messrs. Collins and Coyne), and certain stock option award agreements entered into pursuant to our 2017 Plan on substantially the same terms as the 2018 Plan (collectively, the “Performance Awards”). A summary of such amendments is set forth below. See “Proposal Three – Approval of Amendments to 2018 Performance-Based Stock Incentive Plan and Performance-Based Stock Options” beginning on page 35 for a detailed discussion regarding such amendments, including additional background and the factors considered by the Compensation Committee in evaluating and approving such amendments.

The amendments to the 2018 Plan and the Performance Awards include:

|

|

• |

Amendment of the Stock Price Milestones related to each of the Performance Awards to $17.50, $22.50 and $27.50 per share; |

|

|

• |

Amendment of the exercise prices of the CEO Award and the President Award to $11.97 per share (the closing price of our common stock on June 11, 2020, the last trading day before the approval of the Amendments); |

|

|

• |

Extension of the period of time during which the exercisable portion of the CEO Award and the President Award will remain exercisable in the event of the officer’s separation from service under certain circumstances to the expiration of the 10-year term of such awards; and |

|

|

• |

Removal of Section 2.1(f) of the 2018 Plan, which provides that, unless determined otherwise by a committee of independent and disinterested Board members, neither our CEO nor our President shall be eligible to receive additional equity awards under the 2018 Plan or 2017 Plan. |

If approved by our stockholders, the Compensation Committee intends to make these amendments to the 2018 Plan and the Performance Awards pursuant to its authority under Section 3.5(a) of the 2018 Plan and Section 3.7(a) of the 2017 Plan.

Generally Available Benefit Programs

Section 401(k) Plan

We make available a tax-qualified retirement plan that provides eligible employees, including our executives, with an opportunity to save for retirement on a tax advantaged basis. Participants are able to defer up to 80% of their eligible compensation, subject to applicable annual limits under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). Pre-tax contributions are allocated to each participant’s individual account and are then invested in selected investment alternatives according to the participant’s directions. We do not currently make any matching contributions under the 401(k) plan.

Employee Stock Purchase Plan